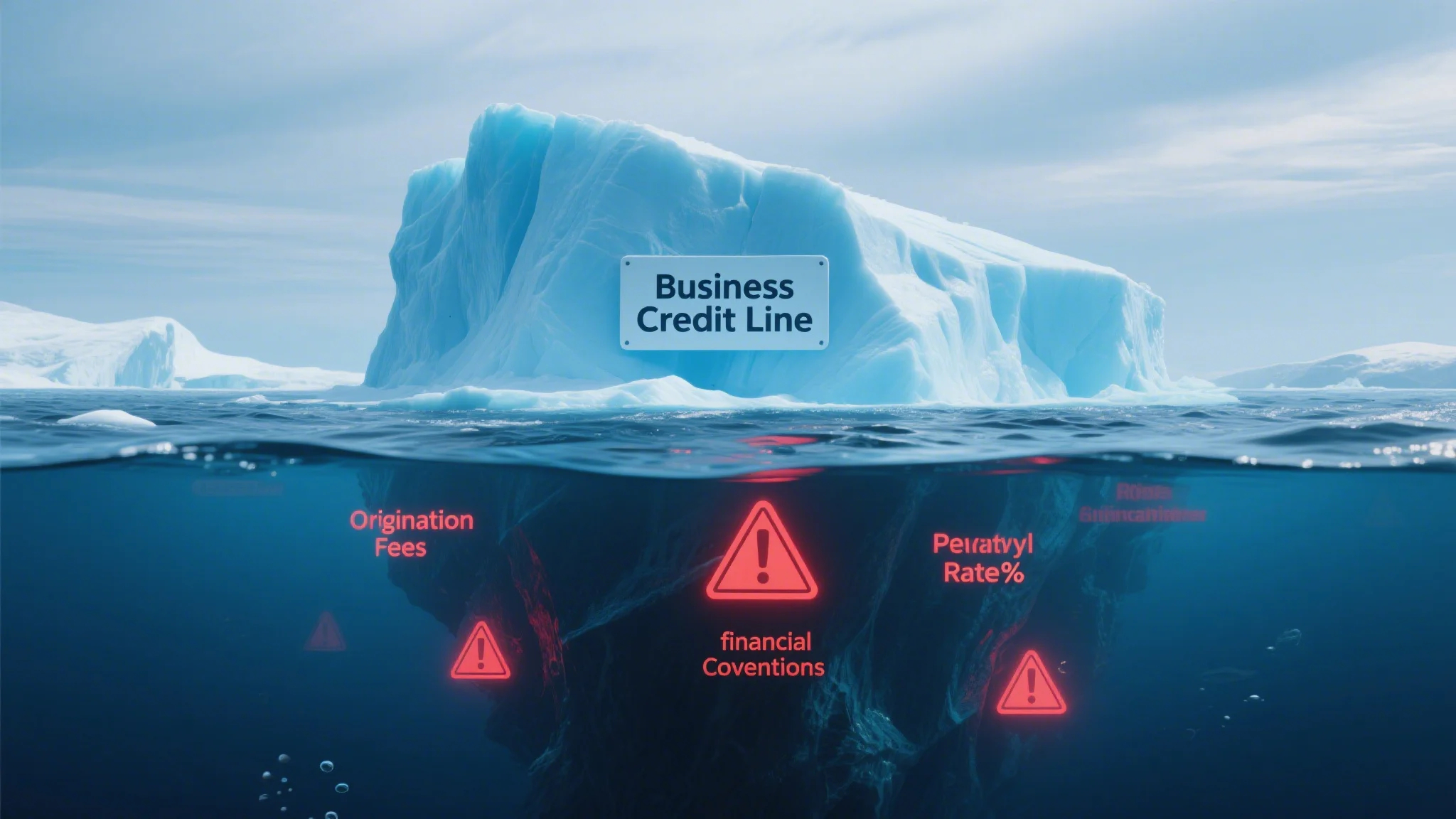

Understanding the True Cost of Business Credit Facilities

When evaluating business credit line options, most entrepreneurs focus primarily on the advertised interest rate, often overlooking numerous other expenses that can significantly impact the total cost of borrowing. These hidden costs typically fall into three categories: periodic fees, transaction charges, and compliance expenses related to loan covenants. The annual percentage rate (APR) calculation should theoretically capture all these expenses, but lenders frequently present this figure in ways that obscure certain charges. Origination fees, for instance, might be deducted from the initial disbursement rather than amortized over the loan term, making them less visible in APR calculations. Maintenance fees often accrue monthly or quarterly regardless of whether the credit line is utilized, creating a fixed cost burden even during periods of non-use…

Covenant Compliance: The Invisible Expense

The most frequently underestimated aspect of business credit arrangements involves the ongoing costs associated with maintaining compliance with loan covenants. These contractual terms often require borrowers to maintain specific financial ratios, meet periodic reporting requirements, and sometimes obtain lender approval for certain business decisions. The administrative burden of covenant compliance can be substantial, particularly for smaller businesses without dedicated accounting staff. Many hidden expenses emerge from the need to hire external accountants or financial consultants to ensure covenant adherence, prepare required documentation, and negotiate covenant waivers when necessary. Certain covenants may also restrict operational flexibility in ways that create indirect costs, such as limiting capital expenditures or requiring maintenance of excessive cash reserves…

Strategic Approaches to Minimizing Credit Costs

Sophisticated borrowers develop comprehensive strategies to mitigate the impact of credit line fees and restrictive covenants. Negotiation before signing the credit agreement represents the most effective opportunity to reduce hidden costs, as lenders often have flexibility in structuring fees and covenant packages for desirable clients. Many businesses successfully negotiate to have certain fees waived or reduced in exchange for maintaining compensating balances or agreeing to slightly higher interest rates. Covenant packages can frequently be customized to better align with the borrower’s business model and growth plans, particularly when the borrower can demonstrate strong historical performance and clear future projections…