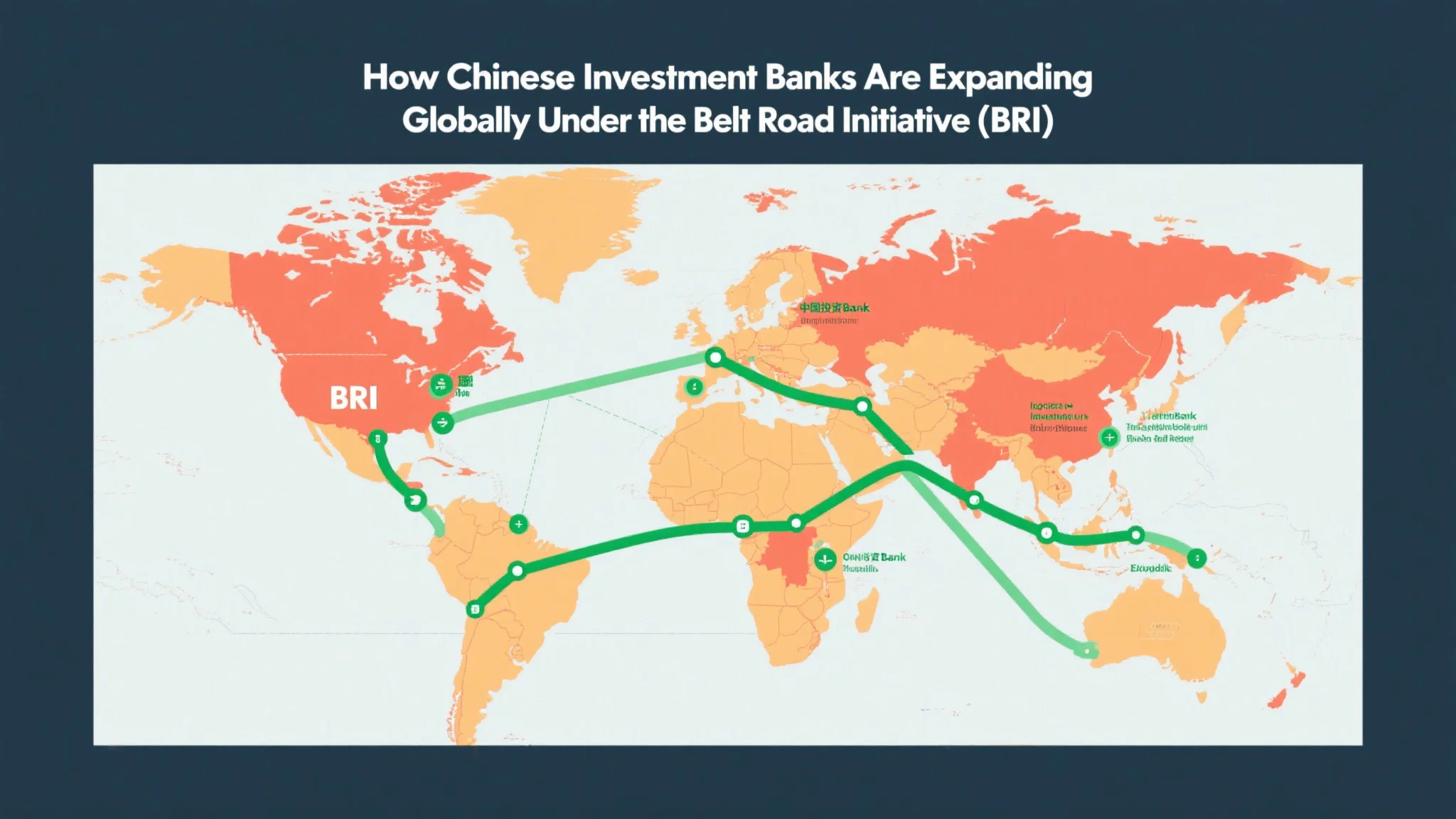

How Chinese Investment Banks Are Expanding Globally Under the Belt and Road Initiative (BRI)

The Belt and Road Initiative has fundamentally transformed the landscape of global infrastructure development and cross-border investment, creating unprecedented opportunities for Chinese investment banks to expand their international presence and establish themselves as major players in global capital markets. This ambitious geopolitical and economic strategy, launched by China in 2013, has opened new avenues for Chinese financial institutions to leverage their expertise in large-scale infrastructure financing and project development across emerging markets in Asia, Africa, Europe, and Latin America. The initiative’s scope and scale have enabled Chinese investment banks to develop sophisticated capabilities in BRI project financing, positioning them as essential intermediaries in the complex web of international infrastructure development that spans multiple continents and involves diverse stakeholder groups.

Chinese investment banks have strategically positioned themselves to capitalize on the massive capital requirements associated with BRI projects, which are estimated to require trillions of dollars in investment over the coming decades. These institutions have developed specialized expertise in structuring complex financing arrangements that can accommodate the unique challenges associated with cross-border infrastructure projects, including currency risks, political risks, regulatory complexities, and the need for long-term capital commitments that align with the extended development timelines typical of major infrastructure initiatives. The evolution of Chinese investment banking capabilities has been driven by the recognition that successful participation in BRI projects requires not only substantial financial resources but also deep understanding of local markets, regulatory environments, and cultural considerations that can significantly impact project success.

The global expansion of Chinese investment banks under the BRI framework has been characterized by strategic partnerships with local financial institutions, government agencies, and international development organizations that can provide valuable market intelligence, regulatory expertise, and risk mitigation capabilities. These partnerships have enabled Chinese banks to navigate complex regulatory environments, establish local presence in key markets, and develop the operational capabilities necessary to support large-scale infrastructure projects across diverse geographic regions. The collaborative approach adopted by Chinese investment banks reflects their understanding that successful global expansion requires more than simply exporting domestic business models, but rather developing adaptive strategies that can accommodate local market conditions and stakeholder expectations.

The competitive advantages that Chinese investment banks bring to BRI projects include their extensive experience with large-scale infrastructure development within China, their access to substantial capital resources through state-owned enterprises and government backing, and their ability to provide integrated financing solutions that combine traditional banking services with specialized project finance capabilities. These advantages have enabled Chinese banks to compete effectively with established international investment banks while offering unique value propositions that are particularly well-suited to the requirements of emerging market infrastructure projects.

Strategic Framework for Cross-Border Investment and Market Entry

The strategic framework employed by Chinese investment banks for international expansion under the BRI has evolved to encompass multiple dimensions of market entry and business development, reflecting the complex nature of cross-border infrastructure financing and the diverse requirements of different regional markets. Chinese cross-border investment strategies have been carefully designed to leverage the comparative advantages of Chinese financial institutions while addressing the specific challenges associated with operating in unfamiliar regulatory environments and managing relationships with diverse stakeholder groups including government agencies, international development organizations, and private sector partners.

The market entry strategies employed by Chinese investment banks have typically involved establishing local subsidiaries or representative offices in key BRI markets, enabling these institutions to develop deep understanding of local business practices, regulatory requirements, and market dynamics that are essential for successful project execution. These local operations serve multiple functions including business development, relationship management, risk assessment, and ongoing project monitoring that ensures compliance with local regulations and international best practices. The establishment of local presence has also enabled Chinese banks to build trust and credibility with local partners and stakeholders, which is crucial for securing mandates for major infrastructure projects that often involve significant political and economic sensitivities.

The development of specialized product offerings and service capabilities has been another key component of Chinese investment banks’ international expansion strategies, with these institutions investing heavily in building expertise in areas such as project finance, trade finance, foreign exchange hedging, and risk management that are essential for supporting complex cross-border infrastructure projects. These capabilities have been developed through a combination of internal talent development, strategic hiring of experienced professionals from international banks, and partnerships with specialized service providers who can provide complementary expertise in areas such as legal advisory, technical consulting, and environmental and social impact assessment.

The integration of technology and digital platforms has also played an important role in enabling Chinese investment banks to scale their international operations efficiently while maintaining high standards of service delivery and risk management. These technological capabilities include sophisticated project management systems, real-time monitoring and reporting platforms, and advanced analytics tools that can support decision-making processes and enable effective coordination between different teams and stakeholders involved in complex multi-jurisdictional projects. The investment in technology infrastructure has been particularly important for Chinese banks seeking to compete with established international players who have traditionally held advantages in terms of global reach and operational sophistication.

Risk management frameworks have been extensively developed to address the unique challenges associated with cross-border infrastructure financing, including political risks, currency risks, regulatory risks, and operational risks that can significantly impact project outcomes and financial returns. Chinese investment banks have developed comprehensive risk assessment methodologies that incorporate both quantitative and qualitative factors, enabling them to make informed decisions about project participation and structure appropriate risk mitigation strategies. These frameworks have been continuously refined based on experience gained from early BRI projects and evolving best practices in international project finance.

The coordination between Chinese investment banks and other Chinese institutions including policy banks, commercial banks, insurance companies, and construction companies has been a distinctive feature of China’s approach to BRI project financing, enabling the creation of integrated financing and implementation solutions that can address the full spectrum of project requirements from initial development through construction and operation. This coordinated approach has provided Chinese investment banks with unique competitive advantages while also creating opportunities for risk sharing and expertise leveraging that can enhance project success rates and financial returns.

Infrastructure Bond Markets and Sovereign Partnership Development

The development of infrastructure project bonds has emerged as a critical component of Chinese investment banks’ global expansion strategy, providing these institutions with opportunities to tap into international capital markets while offering investors access to long-term infrastructure assets that can provide stable returns and portfolio diversification benefits. Chinese investment banks have played increasingly important roles in structuring, underwriting, and distributing infrastructure bonds for BRI projects, leveraging their project finance expertise and growing international networks to connect infrastructure developers with global institutional investors seeking exposure to emerging market infrastructure assets.

The evolution of infrastructure bond markets has been driven by the recognition that traditional bank financing alone cannot meet the massive capital requirements associated with BRI projects, necessitating the development of alternative financing mechanisms that can mobilize institutional investor capital including pension funds, insurance companies, sovereign wealth funds, and asset managers. Chinese investment banks have responded to this challenge by developing sophisticated bond structuring capabilities that can address the specific requirements of different investor types while providing appropriate risk-return profiles for infrastructure investments with long-term investment horizons and complex risk characteristics.

The structuring of infrastructure project bonds requires specialized expertise in areas including credit enhancement, currency hedging, regulatory compliance, and investor relations that Chinese investment banks have developed through their participation in domestic infrastructure financing and their growing international experience. These capabilities have enabled Chinese banks to create innovative bond structures that can accommodate the unique characteristics of cross-border infrastructure projects while meeting the investment criteria and risk management requirements of international institutional investors. The development of these capabilities has been supported by strategic partnerships with international rating agencies, legal advisors, and other service providers who can provide specialized expertise and credibility in global capital markets.

The establishment of sovereign wealth fund partnerships has become an increasingly important element of Chinese investment banks’ international expansion strategies, providing these institutions with access to substantial long-term capital while offering sovereign wealth funds opportunities to participate in large-scale infrastructure development projects that align with their investment objectives and risk tolerance. These partnerships have taken various forms including co-investment arrangements, fund structures, and strategic alliances that enable both parties to leverage their respective strengths and capabilities while sharing risks and returns associated with infrastructure investments.

Sovereign wealth funds have emerged as natural partners for Chinese investment banks in BRI projects due to their long-term investment horizons, substantial capital resources, and interest in infrastructure assets that can provide stable returns and inflation protection. The partnership arrangements typically involve Chinese investment banks providing project origination, structuring, and management capabilities while sovereign wealth funds contribute capital and investment expertise along with valuable relationships and market knowledge in their home jurisdictions. These partnerships have enabled Chinese banks to access new markets and investor relationships while providing sovereign wealth funds with opportunities to participate in infrastructure development projects that might otherwise be difficult to access.

The development of these partnerships has required Chinese investment banks to adapt their business models and operational approaches to accommodate the specific requirements and expectations of sovereign wealth fund partners, including enhanced governance standards, improved transparency and reporting, and alignment with international best practices in areas such as environmental and social responsibility. This adaptation process has contributed to the overall sophistication and international competitiveness of Chinese investment banks while also supporting the development of more sustainable and responsible approaches to infrastructure development.

The success of sovereign wealth fund partnerships has also been dependent on the ability of Chinese investment banks to demonstrate strong track records in project execution, risk management, and value creation that can provide confidence to these sophisticated institutional investors. This has required continuous improvement in operational capabilities, risk management frameworks, and performance measurement systems that can meet the high standards expected by international institutional investors. The development of these capabilities has positioned Chinese investment banks to compete more effectively in global infrastructure markets while also contributing to the overall development of international infrastructure financing markets.

The integration of ESG considerations into infrastructure project development and financing has become increasingly important for attracting sovereign wealth fund investment, with many of these institutions implementing comprehensive sustainability frameworks that require their investment partners to demonstrate strong environmental and social performance. Chinese investment banks have responded by developing enhanced ESG capabilities and incorporating sustainability considerations into their project evaluation and management processes, reflecting the growing importance of responsible investing principles in international capital markets.