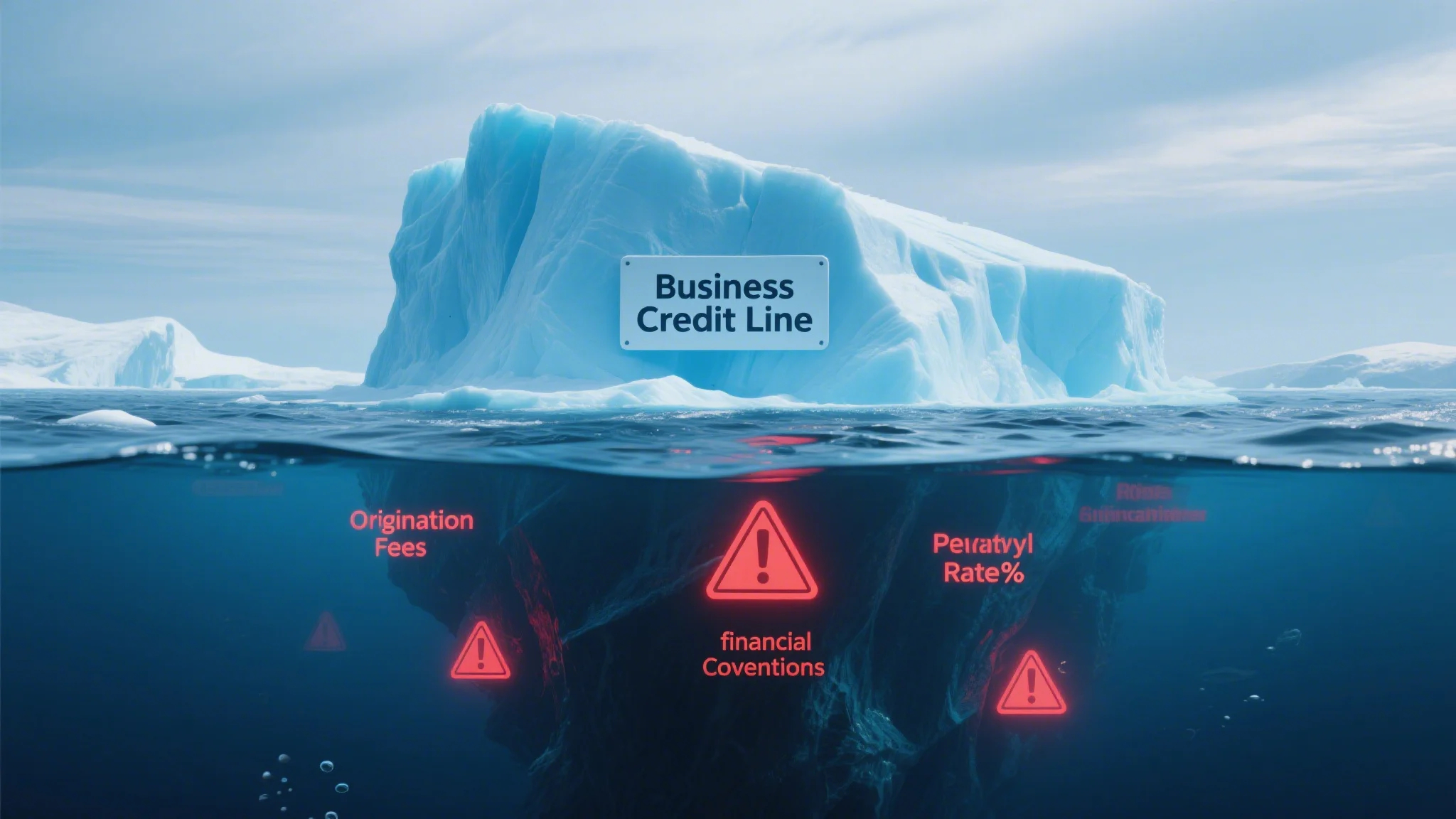

When it comes to financing your business, credit lines can seem like a lifeline. They provide flexibility, allowing you to borrow funds as needed and only pay interest on the amount you use. However, while the concept of a business credit line may seem straightforward, the reality is far more complex. Along with the obvious costs, such as interest rates, there are numerous hidden fees and covenants that can significantly impact your business’s bottom line.

Understanding these hidden costs is crucial for any business owner looking to manage their finances effectively. In this article, we’ll break down the key components of business credit lines, focusing on interest rates, fees, and covenants, and explore how they can affect your business.

The Role of Interest Rates

Interest rates are one of the most well-known costs associated with credit lines, but they’re also one of the most misunderstood. The interest rate you pay on a credit line is determined by several factors, including your creditworthiness, the current market rate, and the lender’s policies.

Variable vs. Fixed Interest Rates:

Most business credit lines come with variable interest rates, which means the rate can fluctuate over time. While this can be beneficial if rates decrease, it can be problematic if rates increase. Fixed interest rates, on the other hand, remain constant throughout the life of the credit line, providing predictable borrowing costs.

How to Calculate Interest:

The interest you pay on a credit line is typically calculated based on the outstanding balance. For example, if you have a $100,000 credit line with an annual interest rate of 5%, and you borrow $50,000, you’ll pay interest on that $50,000. The interest is usually compounded daily, which means even a small balance can accumulate significant interest over time.

The Impact of Fees

In addition to interest rates, there are several fees associated with business credit lines that can add up quickly. These fees include origination fees, annual fees, and transaction fees.

Origination Fees:

Origination fees are charged by the lender when you first set up the credit line. These fees are typically a percentage of the credit line amount and are deducted from your available funds. For example, a 1% origination fee on a $100,000 credit line would cost you $1,000 upfront.

Annual Fees:

Annual fees are recurring costs associated with maintaining the credit line. These fees can range from a few hundred to several thousand dollars, depending on the lender and the size of the credit line. While annual fees might seem manageable, they can add up over time, especially if you have multiple credit lines.

Transaction Fees:

Transaction fees are charged every time you draw on the credit line or make a payment. These fees can vary widely, but they often range from $5 to $50 per transaction. If you’re frequently borrowing and repaying funds, transaction fees can quickly eat into your profits.

The Importance of Covenants

Covenants are the terms and conditions outlined in your credit agreement that you must adhere to in order to maintain the credit line. While covenants can vary depending on the lender, they often include restrictions on how you use the funds, limits on your financial ratios, and requirements to provide regular financial statements.

Financial Covenants:

Financial covenants are designed to ensure that you maintain a certain level of financial stability. For example, a covenant might require that your debt-to-equity ratio doesn’t exceed a specific threshold. If you fail to meet these covenants, the lender may impose stricter terms or even demand repayment of the outstanding balance.

Operational Covenants:

Operational covenants typically restrict how you use the funds. For instance, you might be prohibited from using the credit line for certain expenses, such as entertainment or travel, unless specified in the agreement. These covenants are in place to minimize the risk to the lender, but they can also limit the flexibility of your credit line.

Now that we’ve covered the basics of interest rates, fees, and covenants, it’s time to delve deeper into how these hidden costs can impact your business and what you can do to mitigate them.

Strategies to Minimize Hidden Costs

Shop Around for the Best Rates and Terms:

Don’t settle for the first credit line offer you receive. Take the time to compare multiple lenders and their respective terms. Look for lenders that offer competitive interest rates, low or no origination fees, and flexible covenants.

Negotiate Terms with Your Lender:

Many lenders are willing to negotiate terms, especially if you’re a good credit risk. For example, you might be able to reduce the origination fee or negotiate a lower interest rate. Be prepared to demonstrate your business’s financial stability and growth potential to strengthen your case.

Monitor Your Usage:

Avoid borrowing more than you need, as this can lead to unnecessary interest and fees. Keep track of your credit line usage and aim to repay the funds as quickly as possible to minimize interest accumulation.

Review Your Agreement Regularly:

Financial situations change, and so do market conditions. Review your credit agreement periodically to ensure that the terms still meet your business’s needs. If your financial situation improves, you might be able to renegotiate for better terms.

Consider Alternative Financing Options:

If the hidden costs of a credit line are too high, explore alternative financing options, such as term loans or equipment financing. These options may offer more predictable repayment terms and lower overall costs.

The Long-Term Implications

While it’s important to focus on the short-term benefits of a business credit line, it’s equally crucial to consider the long-term implications. High interest rates, excessive fees, and restrictive covenants can have a lasting impact on your business’s financial health.

For example, if you’re paying a high interest rate on a credit line, you’re effectively reducing your profit margins. Over time, this can make it difficult to invest in growth opportunities or even cover day-to-day expenses. Additionally, failing to meet covenant requirements can lead to financial penalties or the loss of your credit line altogether.

Business credit lines can be a valuable tool for managing cash flow and funding growth, but they’re not without their