In today’s competitive business environment, securing a revolving credit line is essential for maintaining cash flow, managing expenses, and seizing growth opportunities. Whether you opt for a traditional bank or an alternative lender, understanding the differences and choosing the right fit for your business is crucial. This article explores the pros and cons of both options, helping you make an informed decision.

A revolving credit line is a financial tool that provides businesses with a reusable source of funds, up to a predetermined credit limit. Unlike a term loan, which is a one-time lump sum, a revolving credit line allows you to borrow, repay, and borrow again, as long as you stay within the credit limit and meet the terms of the agreement. This flexibility makes it an ideal solution for businesses that need consistent access to capital for operational expenses, inventory, or unexpected costs.

When it comes to securing a revolving credit line, businesses have two primary options: traditional banks and alternative lenders. Each option has its own set of advantages and disadvantages, and the choice between them often depends on the specific needs of the business, its financial health, and the urgency of the funding requirement.

Why a Revolving Credit Line Matters for Your Business

Before diving into the differences between banks and alternative lenders, it’s important to understand why a revolving credit line is a valuable asset for any business. Here are some key benefits:

Flexible Funding: A revolving credit line allows you to access funds as needed, without having to reapply for a new loan each time. This flexibility is particularly useful for businesses with unpredictable cash flow or seasonal fluctuations.

Improved Cash Flow: By having a revolving credit line, you can manage your cash flow more effectively. Instead of waiting for invoices to be paid or relying on savings, you can use the credit line to cover immediate expenses and pay it back over time.

Seize Growth Opportunities: Whether it’s expanding your product line, hiring new staff, or entering a new market, a revolving credit line provides the capital needed to seize growth opportunities without disrupting your business operations.

Build Credit History: Using a revolving credit line responsibly can help build your business’s credit history, making it easier to secure larger loans or better terms in the future.

How to Secure a Revolving Credit Line

Before you can decide between a bank or an alternative lender, you need to ensure that you’re a strong candidate for a revolving credit line. Here are some steps to take:

Assess Your Financial Health: Lenders will evaluate your business’s financial health, including your credit score, revenue, profit margins, and debt-to-equity ratio. A strong financial profile increases your chances of approval and better terms.

Build a Strong Relationship: If you’re applying through a bank, consider establishing a relationship with the lender before applying for the credit line. This can involve opening a business checking account, maintaining a positive transaction history, or securing a business loan in the past.

Provide Necessary Documentation: Be prepared to provide financial statements, tax returns, and other documentation to prove your business’s stability and profitability.

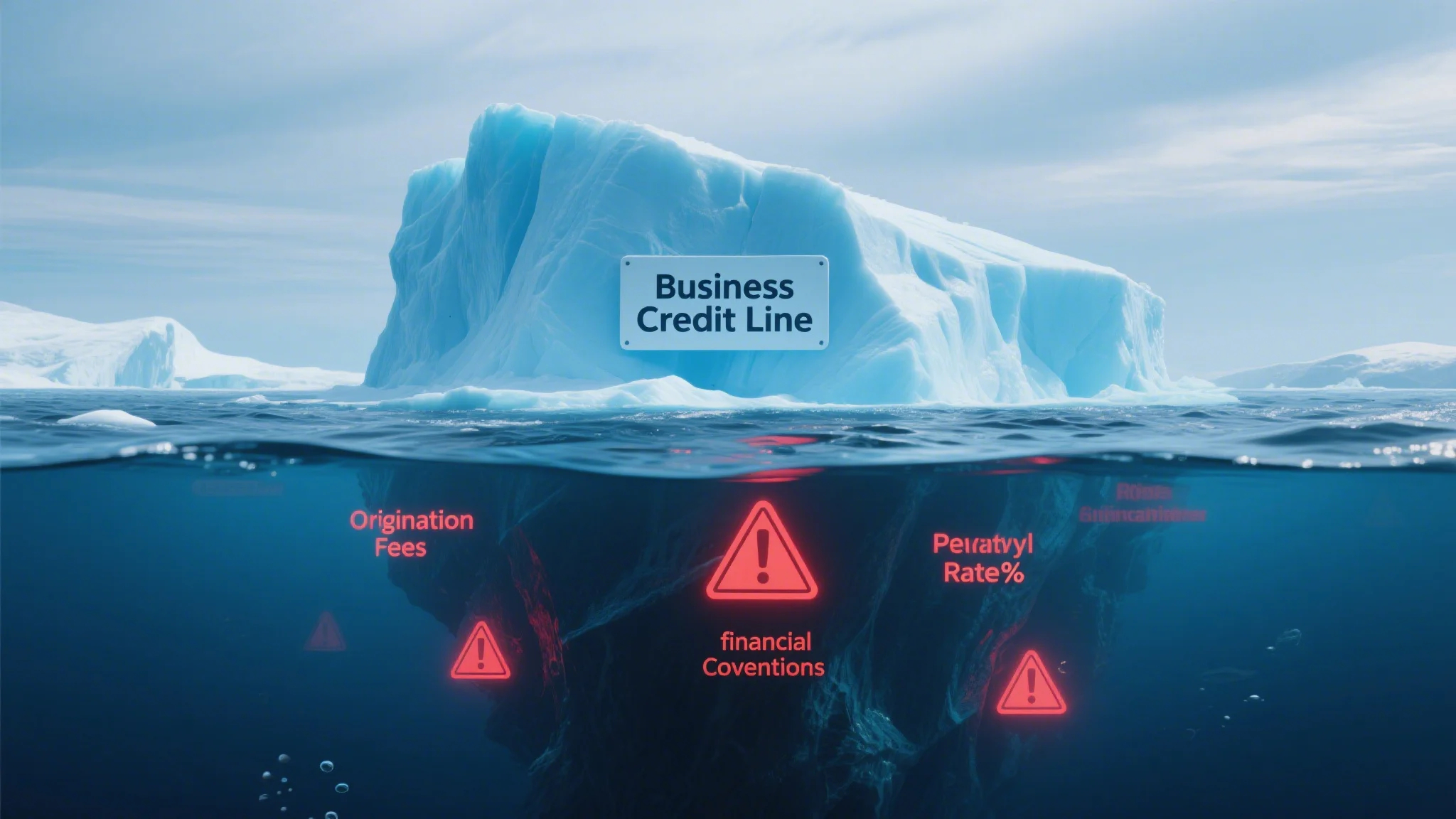

Understand the Terms: Before signing, make sure you understand the terms of the revolving credit line, including interest rates, fees, and any restrictions on how the funds can be used.

Negotiate the Best Deal: Don’t hesitate to negotiate terms with the lender. For example, you might be able to lower the interest rate or reduce fees by offering a higher down payment or providing additional collateral.

The Role of Traditional Banks

Traditional banks have long been the go-to source for business loans, including revolving credit lines. Here’s why banks remain a popular choice for many businesses:

Established Reputation: Banks are well-established financial institutions with a proven track record of providing loans to businesses. This gives borrowers confidence in their reliability and stability.

Low Interest Rates: Banks often offer competitive interest rates, especially for businesses with strong financial profiles.

Multiple Products and Services: In addition to a revolving credit line, banks may offer other financial products, such as term loans, savings accounts, and investment services, all under one roof.

Local Relationships: For small businesses, especially those in local communities, banks can provide personalized service and a deeper understanding of the borrower’s unique needs.

However, there are some drawbacks to consider when choosing a bank for your revolving credit line.

Strict Requirements: Banks typically have strict underwriting criteria, which can make it harder for businesses with lower credit scores or less financial history to qualify.

Longer Processing Times: The approval process for a revolving credit line through a bank can be lengthy, often taking weeks or even months. This can be a disadvantage for businesses that need quick access to funds.

Limited Flexibility: While banks offer a range of financial products, their terms and conditions may not always be flexible enough to meet the specific needs of every business.

The Rise of Alternative Lenders

In recent years, alternative lenders have emerged as a popular option for businesses seeking revolving credit lines. These lenders, which include online finance companies, credit card issuers, and private investors, offer a range of financial products designed to meet the needs of businesses that may not qualify for traditional bank loans.

Here are some of the key advantages of choosing an alternative lender:

Faster Approval Process: Alternative lenders are known for their quick turnaround times, with many offering same-day or next-day funding for approved applicants. This makes them an ideal choice for businesses with urgent funding needs.

More Flexible Terms: Alternative lenders often offer more flexible terms compared to banks, including higher credit limits and lower down payment requirements.

Easier Access for Smaller Businesses: Many alternative lenders cater specifically to small businesses and startups, which may not meet the strict criteria of traditional banks.

Innovative Products: Alternative lenders are constantly innovating, offering a variety of financial products tailored to the needs of modern businesses. For example, some lenders now offer revolving credit lines specifically designed for e-commerce businesses or tech startups.

However, there are also some potential drawbacks to consider when choosing an alternative lender.

Higher Interest Rates: While alternative lenders may offer more flexible terms, they often come with higher interest rates compared to banks. This can make them a more expensive option in the long run.

Limited Customer Service: Unlike banks, alternative lenders may not provide the same level of customer service or support. This can be a problem if you encounter issues or need assistance with your revolving credit line.

Less Predictable Fees: Alternative lenders may charge a variety of fees, including origination fees, maintenance fees, and early repayment fees. It’s important to carefully review the terms to avoid hidden costs.

Choosing the Right Lender for Your Business

When deciding between a bank and an alternative lender, it’s important to evaluate your business’s specific needs and goals. Here are some questions to ask yourself:

What Are My Urgency and Flexibility Needs? If you need funds quickly and have the flexibility to repay over time, an alternative lender may be the better option. However, if you’re in no hurry and prefer a more