In the ever-evolving business world, companies often encounter periods of distress due to economic downturns, poor management, or unfavorable market conditions. During these challenging times, investment banks emerge as crucial partners, guiding companies through strategic restructuring to regain stability and achieve sustainable growth. This article delves into the essential strategies employed by investment banks to facilitate corporate recovery, highlighting their transformative impact.

Understanding Corporate Restructuring

Corporate restructuring is a multifaceted process aimed at improving a company’s financial health and operational efficiency. It involves reorganizing various aspects, including debt, equity, operations, and management, to enhance profitability and market competitiveness. Investment banks play a pivotal role in this process by providing expert financial advice, restructuring plans, and facilitating transactions that aid in recovery.

Financial Restructuring: A Cornerstone of Recovery

One of the primary strategies investment banks employ is financial restructuring. This involves renegotiating debt terms, optimizing capital structure, and enhancing cash flow management. By restructuring debt, companies can reduce interest burdens and extend maturity periods, providing much-needed financial flexibility. Investment banks negotiate with creditors, offering balanced solutions that ensure both companies and creditors benefit.

Operational Turnaround: Streamlining for Efficiency

Beyond financial restructuring, investment banks often recommend operational turnarounds. This strategy focuses on improving efficiency, reducing costs, and enhancing productivity. By analyzing a company’s operations, banks identify inefficiencies and propose actionable solutions, such as process optimization, technology integration, and workforce restructuring. These measures help companies cut costs and redirect resources toward growth initiatives.

Strategic Divestitures: Unlocking Value

Sometimes, divesting non-core assets is crucial for recovery. Investment banks assist in identifying and valuing underperforming assets, facilitating their sale to maximize value. This not only generates cash but also streamlines the business, allowing the company to concentrate on core competencies. Strategic divestitures can significantly boost a company’s financial health and market position.

Case Study: Reviving a Manufacturing Giant

Consider a global manufacturing company that faced declining profits due to over-leverage and inefficiencies. The investment bank initiated financial restructuring, renegotiating $500 million in debt, reducing interest expenses by 30%, and extending maturity periods. Concurrently, operational improvements were implemented, cutting costs by 20% through technology upgrades and process re-engineering. Non-core assets were divested, generating $200 million in cash. Within two years, the company’s profitability rebounded, and it emerged as a leaner, more competitive entity.

Leadership and Organizational Restructuring: Pivotal for Success

Effective leadership is vital during corporate restructuring. Investment banks often advise leadership changes to bring in experienced executives who can steer the company through recovery. Additionally, organizational restructuring may involve flattening hierarchies, decentralizing decision-making, and enhancing employee engagement. These changes foster a culture of accountability and innovation, crucial for long-term success.

Leveraging Financial Markets for Recovery

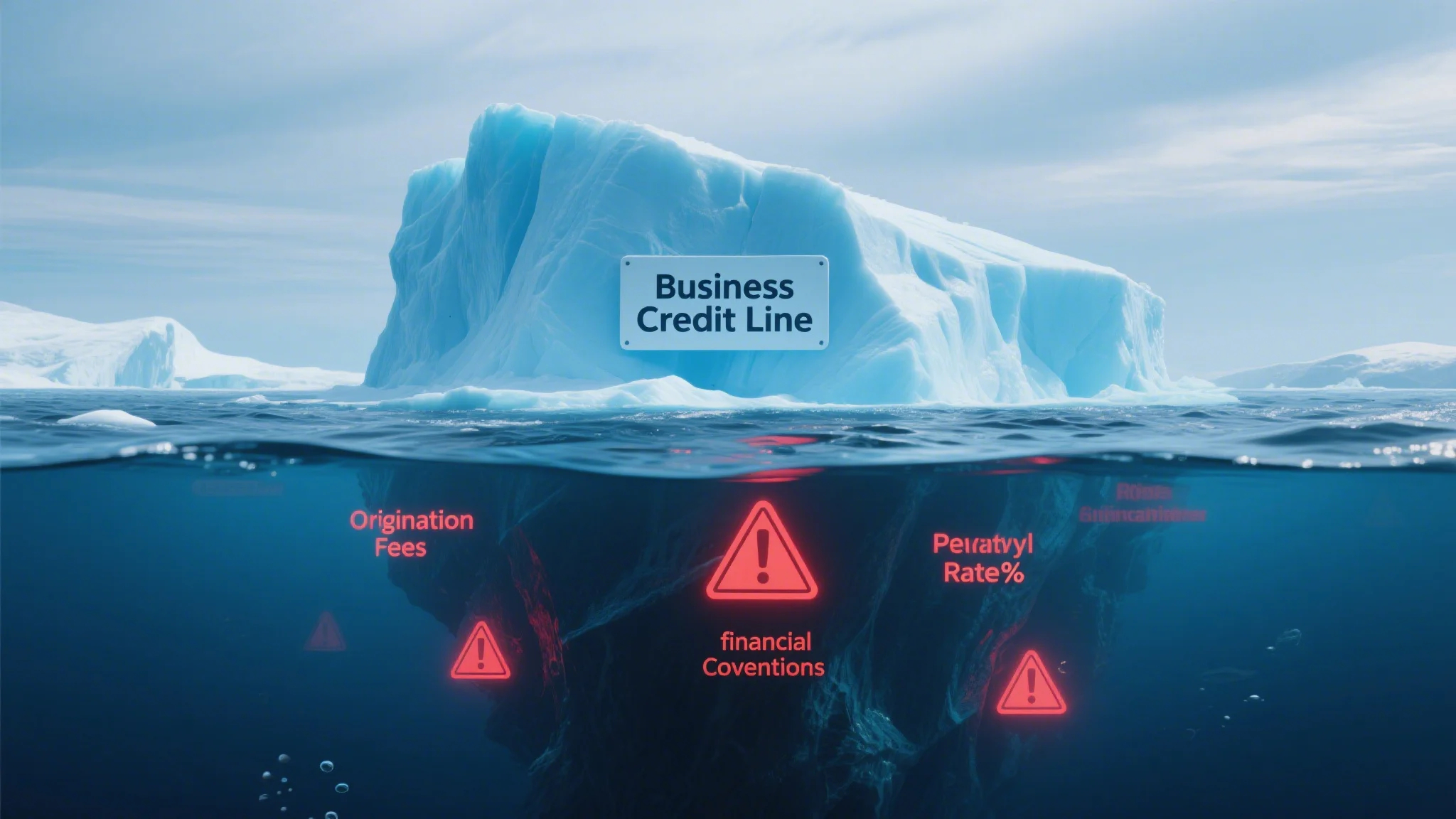

Investment banks utilize financial market instruments to aid recovery. By issuing new debt or equity, companies can raise capital for restructuring efforts.banks facilitate these transactions, ensuring optimal terms and market reception. Additionally, they may recommend establishing or enhancing credit facilities to provide liquidity during recovery phases.

Long-Term Recovery Planning: Ensuring Sustainability

Sustaining recovery requires a well-structured long-term plan. Investment banks help companies develop strategic roadmaps, focusing on revenue growth, market expansion, and risk management. These plans ensure that companies not only recover but also build resilience against future challenges.

Case Study: A Retail Giant’s Comeback

A prominent retail company, burdened by high debt and declining sales, sought investment bank assistance. The bank facilitated a leadership overhaul, bringing in a new CEO with e-commerce expertise. Operational restructuring included closing underperforming stores, adopting digital platforms, and streamlining supply chains. Financial restructuring involved converting $1 billion in debt to equity, reducing interest expenses. Post-restructuring, the company achieved a 30% increase in online sales and returned to profitability within 18 months.

: The Transformative Power of Investment Banks

Investment banks are indispensable in guiding distressed companies through restructuring, offering expertise, strategic insights, and transactional support. Their multifaceted approach, encompassing financial, operational, and leadership restructuring, ensures comprehensive recovery. By leveraging financial markets and developing long-term strategies, investment banks enable companies to emerge stronger, setting the stage for future success. In an era of constant change, the role of investment banks in corporate restructuring is more vital than ever, serving as beacons of hope for companies navigating challenging waters.